Wayne State University School of Business faculty, students and alumni recognized for tax service to Detroit's low-income population

April 15 is a date that stands out on the calendar: Tax Day. Many of us experience at least a little stress as this annual deadline approaches. However, for many Americans who need tax-preparation assistance that they cannot afford, this stress can become overwhelming.

That’s where VITA comes in. The Volunteer Income Tax Assistance program, or VITA, is an Internal Revenue Service endeavor to assist middle- to low-income individuals with tax preparation. The program has specific tools to aid the elderly, people with disabilities and individuals not fluent in English. The program targets concerns specific to middle- to low-income individuals such as the earned income tax credit.

In Southeast Michigan, extensive VITA services are provided through the Accounting Aid Society (AAS) … and a lot of those services are provided by individuals with ties to Wayne State.

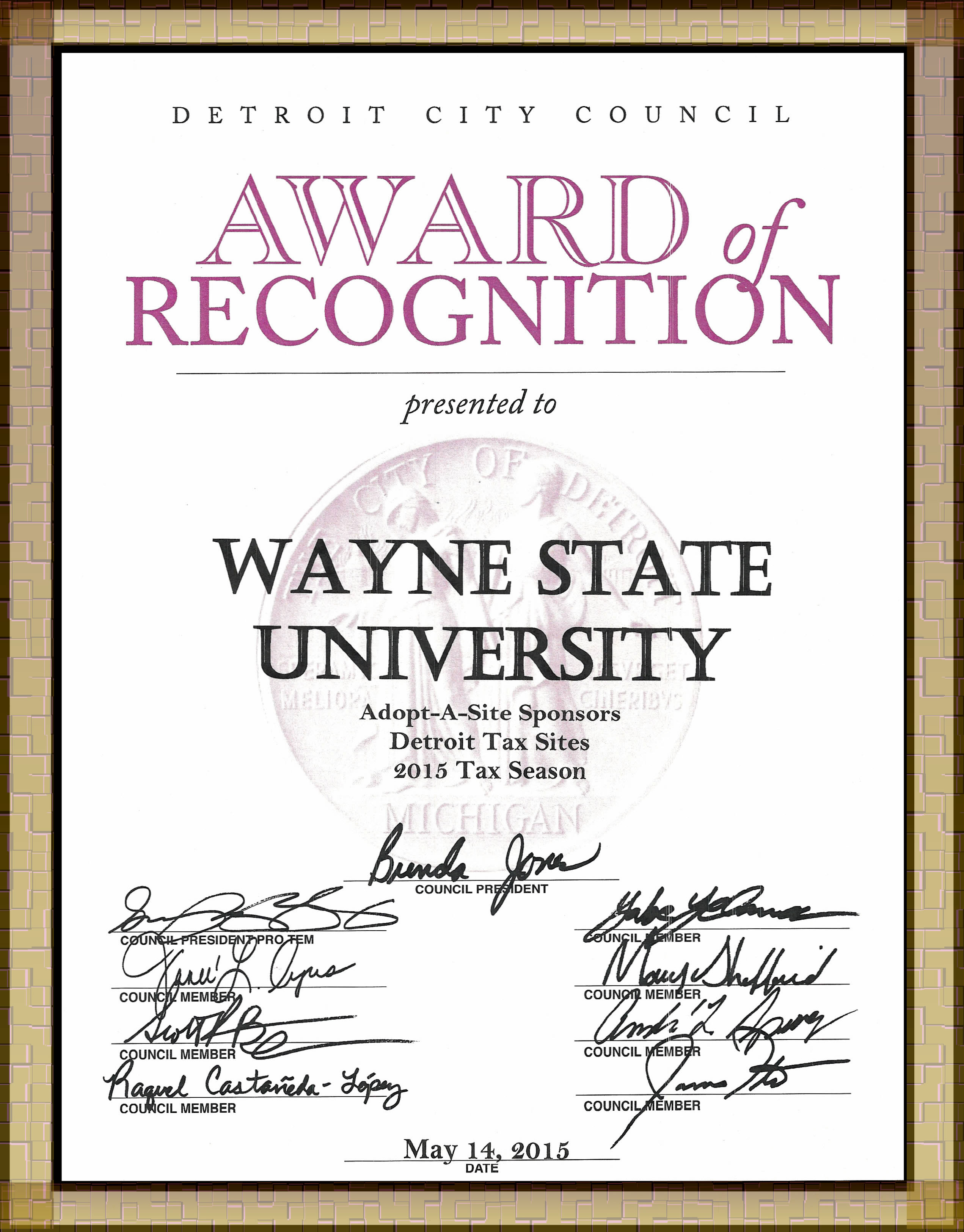

This May, the university received an "Award of Recognition" from Detroit City Council for its work in support of AAS, and several students and faculty – and even one alumnus – were recognized for their service.

In all, 23 WSU accounting students were recognized at AAS’ annual Volunteer Tribute in May. In addition, two faculty members, Antonie Walsh and Deborah Habel, were honored for their recruitment efforts, and an alumnus of the business school, Candelario Benavides, received the Outstanding IT Volunteer Award.

Experiential learning that does some good

In fall 2010, Marshall Hunt, director of tax policy and advocacy at AAS, came to WSU to discuss the VITA program. Walsh, senior lecturer of accounting, began incorporating the VITA program into her Introduction to Taxation courses (ACC 5170/7120).

Walsh said that volunteering for AAS gives students the experience of how to work with people, rather than going based off a project that she creates.

"This gives them the opportunity to get the facts out of people," Walsh said. "In the class you have all the facts there."

Walsh, who has been teaching at WSU since 1994, said students sometimes have to ask uncomfortable questions.

"It’s their obligation to the tax payer to get accurate information," she said.

Walsh had seven students in her class participate in the program during the winter term. She said that students who participated in the program were sometimes introduced to course material earlier than it was presented in class, which gave them an advantage.

For some students, it was their first time preparing taxes and many expressed the program as a humbling experience. One student was able to assist an Arabic family who had trouble with English. Another student helped a couple figure out that they were better off filing separately.

From undergraduate to professional

Habel, lecturer of accounting, was first solicited by AAS as an undergraduate in the mid-1980s and has volunteered off and on ever since.

Habel said the experience has changed tremendously over the years. She recalls when the program was run out of a gymnasium in the Butzel Family Center. Clients and preparers would meet at cards table in the gymnasium. Clients would line up and wait for an available preparer. Now, people call and make appointments.

Habel said the process is much better for the preparers and clients, especially since the tax work is all done online. Habel remembers in 1989 when, with the help of Marshall Hunt, the center did its first "e-filing." Of course, back then e-filing meant that the forms would be prepared manually, and then Hunt would go to the computer and punch in a few codes to process the data and get it to the IRS.

While technology has evolved over the years, so have the services provided by AAS. According to Habel, the organization does much more than just file tax returns. They have financial literacy programs and even coaching programs for entrepreneurs.

"AAS is contributing to the resurgence of Detroit at the grassroots level," she said.

It’s all in a name

WSU business alumnus Candelario Benavides (B.S. ’06 and M.B.A. ‘15) gained interest in AAS after seeing the organization’s name while driving in southwest Detroit. He was originally going to volunteer as a tax preparer, but he noticed that the organization also needed help with information technology. He already had experience preparing individual taxes, so he decided to try something new and go for the IT role.

As part of his IT job, Benavides helped set up and tear down laptops, printers, scanners and networking equipment for the tax preparers.

Benavides said while he did not prepare tax returns this year, he may do so in the future and learned a lot from watching his fellow volunteers.

"I learned that the services this organization provides are valuable and that there is tremendous demand from the community for these services," he said. "I witnessed the smiles on people’s faces as they finished their taxes, and it felt extremely satisfying to be a part of the team that made it happen."

Benavides, who works as a budget analyst at WSU School of Medicine’s Fiscal Affairs Office, plans on returning next year to help support AAS, and he encourages other students within the School of Business to get involved outside the classroom.

"I guarantee you will gain experience that will not only enhance your career, but also provide a sense of achievement knowing you helped make a difference in someone’s life," he said.

Get involved

WSU business students often get their first exposure to AAS through organizations like Beta Alpha Psi, Beta Gamma Sigma, Delta Sigma Pi and National Association of Black Accountants. That said, you certainly don’t need to be a student to volunteer. AAS had 608 volunteers who donated 19,243 hours of tax preparation service at 22 locations in Detroit, which resulted in more than $21 million in tax refunds and credits to the community.

To learn more about volunteer opportunities, visit accountingaidsociety.org/volunteers/.